Sep 23, 2022

Clawback is a term in sales that means refunding paid sales commissions to the company.

The idea of a clawback policy can cause unease among the salesforce. Let's explore this nuanced topic to learn more about clawbacks in sales compensation.

Let's use a simple example in SaaS sales. A sales team sells a client a $50,000 1-year subscription to a b2b software. Due to unforeseen circumstances, the subscription is canceled, resulting in the loss of the sale to the company after the commission was already paid to the sales team.

In this case, the company will need to initiate a clawback to recover the commission cost on a canceled sale.

Let's say the sales team earned a commission of 5% or $2500. The company will clawback $2500 from future commission earnings.

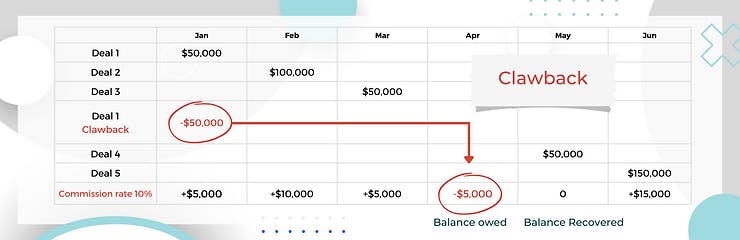

The graphic above illustrates 3 different deals:

The commission rate for each deal is 10%. In deal 1, the company paid out a commission of $5000 in January.

As deal 1 was canceled, the company initiated a clawback in April to recover the sales team's commission of $5000.

The $5000 clawback will come from the sales commission on future deals. For example, if the sales team earns a commission of $7000 on an upcoming deal, $5000 of that commission will be clawed back.

The main reasons why companies use clawbacks in their sales commission plans are:

If the company didn’t get paid, why should the sales rep/team?

Sales commissions are a significant line item in company budgets. This hurts the bottom line as commissions can be between 15% - 40% of the deal in the software industry.

The goal is to ensure the product and the business use case are a good fit. The last thing any company wants is a prospect excited about their solution only to realize later that it will not solve a real pain point.

A clawback is the consequence of a bad deal. Clawbacks encourage sales reps to find product market fit.

Nevertheless, there are many reasons deals are canceled that are outside of the sales rep's control.

Although extremely rare, there have been unfortunate cases of fraudulent activities in sales.

For example, a sales rep creates a deal that never happened. The deal is worth $250,000, and the rep is set to receive a 4% commission of $10,000.

The terms of this $250,000 deal are “Net 30”, meaning the client must pay $250,000 within 30 days of signing the agreement. The company wisely pays out commissions monthly just in case of any clawbacks. So at the 30-day mark, accounting realizes that this invoice was not paid and pauses the commission. On day 60, things look suspicious, so sales ops initiate a clawback. This is a severe offense, so the rep gets fired and has serious legal problems.

If a clawback was not in place, the company would have lost $10,000 due to preventable sales fraud.

Clawbacks are a negative form of sales compensation. In many instances, the loss of sale resulted from payment collection, implementation, or other factors outside of the sales team’s control.

Imagine closing a deal, getting paid commission, and then losing sales commission later because of factors outside your control. Sales reps are nervous about losing money from future paychecks based on past cancellations.

One of the most challenging things a sales commissions team handles is clawback exception requests from sales reps. Sales teams put in the time and effort, but the deal never happened. It is a gray area. You want a motivated team but don’t want to lose money.

This is especially true if a top performer initiates the clawback exception request. You don’t want to lose a top performer.

A clawback exception is a judgment call that almost always requires executive review and approval. It can even go up to the CEO.

Need help with clawbacks and other parts of your Sales Compensation plan? We'll be happy to help you. Learn more about ZenCentiv Sales Commission Software .