Sep 19, 2022

OTE is short for on-target earnings. As a sales rep, your OTE is your expected earnings when you reach 100% of your quota. In other words, A sales rep's OTE represents their base salary + 100% of the quota attained.

Annual Base Salary + Annual Commission at 100% Quota Attainment = OTE (On-target earnings)

For example, let’s say your base salary as an account executive at a SaaS company is $60,000, and your annual commission at 100% quota attainment is $70,000, then your OTE is $130,000.

Yes! Ask your interviewer, "Can you tell me what percent of this company's sales force achieved 100% or more of their OTE last year? If less than 70% of on-target earnings were reached, they set the bar too high in their sales compensation plan.

Sometimes this is referred to as “average rep earnings.”

It is crucial to understand how much of the sales team achieved OTE to know if you can realistically earn On-Target Earnings.

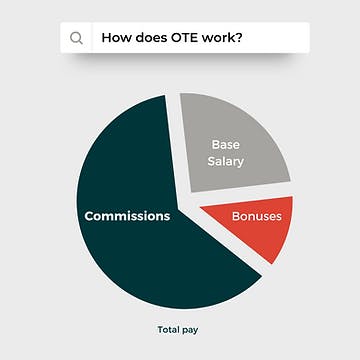

The pay mix is the OTE split between base salary and variable pay.

For example, a 60/40 pay mix means that 60% of your OTE goes toward base salary and 40% towards variable pay. Variable pay can include commissions, bonuses, and other types of compensation.

Let’s say your OTE is $100,000. In a 60/40 pay mix, your base salary is $60,000, and 40% is your variable pay.

Please read our sales commissions glossary of terms.

Guaranteed pay is your base salary. You are guaranteed this compensation by simply showing up and doing your job as a sales representative. Pay at risk, on the other hand, is your commissions, bonuses, etc., and is not guaranteed.

This is essentially another way of explaining your pay mix.

When you are new to a sales job, you often need time to ramp up and learn your new product offering. This is particularly true in SaaS and other complex offerings. Employers anticipate this ramp-up time and offer you guaranteed sales commissions for a period of time.

For example, an account executive with a B2B software company has a pay mix of 50/50, a base salary of $55,000, and $55,000 in commissions at full quota attainment. So the OTE, in this case, is $110,000.

But let’s say there is a 6-month learning curve making 50% of your OTE unreachable because of the ramp-up time. The employer can offer a 6-month sales commission draw. For the first 6 months, the sales account executive will be paid their full OTE regardless of performance.

After the commission draw period is over, the account executive’s salary reverts to 50% base salary + 50% variable commission.

A recoverable commission draw means that your guaranteed commissions paid out to you during your ramp-up time as a new sales team member are recoverable by your employer by holding back future commissions until the draw has been earned back. It’s similar to a loan in some ways.

A non-recoverable draw is ideal for the sales rep starting a job. Why? Because the commission draw is essentially free money, it does not need to be paid back in the future. This allows for ramp-up time and no debt at the end of that learning period.

For example, you are offered a sales rep position with a base salary of $60,000 and variable pay of $45,000. Your OTE is $105,000. If your employer offers you a 3-month sales commission draw, they guarantee you $11,250 of variable income in your first 3 months.

If that draw is recoverable, they will hold back future commissions to recover that draw. On the other hand, if the draw is non-recoverable, consider it an $11,250 free gift as you skill up in your new position.